High-yield savings with easy access

Grow your wealth with high yield savings, and interest paid daily. Benefit from a competitive rate, FSCS protection and easy next working day withdrawals.

Your savings deposits are eligible for protection by the Financial Services Compensation Scheme (FSCS) - up to £120,000 per person, per bank.

In the event that a bank fails, the FSCS can pay compensation, giving you peace of mind alongside attractive returns.

Our dedicated team is focused on maximising your wealth.

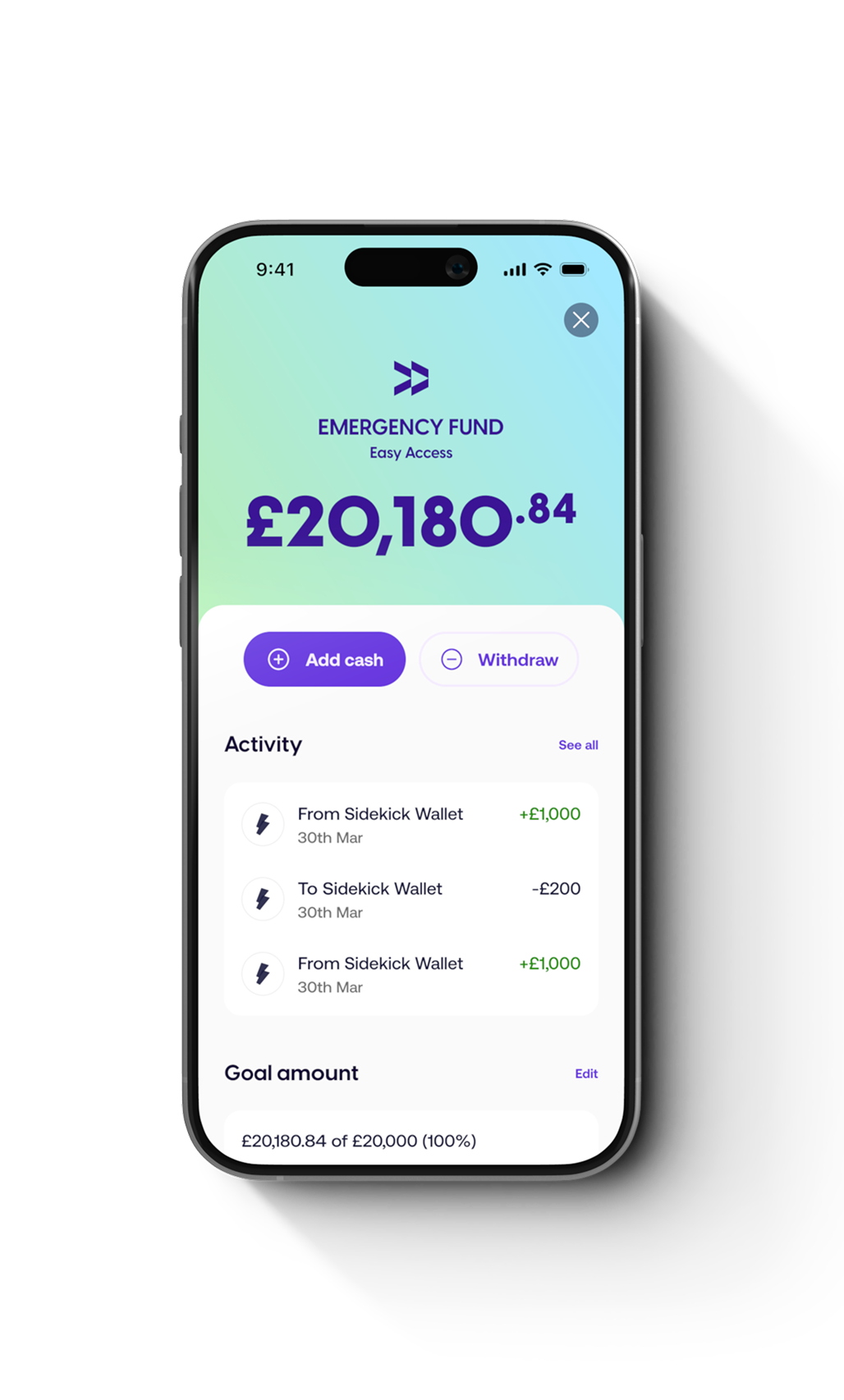

Tap the cash management card on your home screen and explore our Easy Access savings account.

.png)

Follow the simple on-screen instructions to set up your savings account.

.png)

Deposit funds into your Sidekick wallet and add them to your chosen account.

Quick answers to your top questions

Competitive Interest rate

When you open a Sidekick Easy Access savings account, you’ll earn an underlying variable rate from one of our trusted partner banks.

For our product with OakNorth Bank, you will earn 3.57% AER (variable).

Interest accrual

Interest on funds in your savings account will be paid daily, and your bonus will be paid monthly.

Access to your funds

You’ll have easy access and unlimited next working day withdrawals.

Here's a link to the OakNorth Summary Box:

View Summary Box

From time-to-time we apply bonuses to the underlying savings rates provided by our partner banks. We'll let you know when a bonus is available on a product, and if you're eligible.

Any bonuses will be paid directly into your Sidekick Wallet. The Sidekick bonus rates can vary at our discretion, but we'll notify you if this happens.

Sidekick offers savings products from a number of banks via our partner Bondsmith. Our latest Easy Access savings account is provided by OakNorth Bank, a fully regulated UK bank.

OakNorth Bank plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (Financial Services Register number: 629564).

Your deposits with OakNorth are protected up to £120,000 by the Financial Services Compensation Scheme (FSCS). Any deposits you hold above the limit are unlikely to be covered.